Demonetisation is stripping a particular currency unit of its status as the legal tender. This generally happens when the national currency of a particular country is changed. The current money in circulation is mulled out of the market and new coins and notes replace them. At time, through demonetization, a country can replace its old currency with brand new currency. This is done to fight inflation, corruption, crime and discourage cash-dependent economy.

|

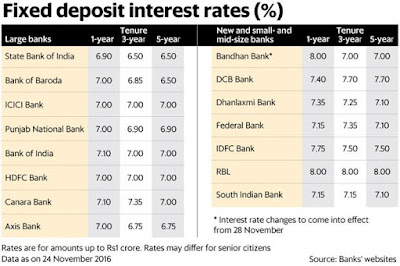

| Fixed Deposit Rates 2017 |

Reserve Bank of India rate cuts and surge in the bank deposits post demonetization have reduced the overall rate of interest in the system. At present, the fixed deposit rates of interest are at a multi-year lows. The rate of interest offered by the State Bank of India is between 5.50% and 6.90% across various maturities on the retail deposits. The repo rate has been held steady by the Reserve Bank of India for a specific amount of time. However, the cut by 175 basis points in the key lending rate from January 2015 led to a huge decline in the overall rate of interest. The surge in deposits post demonetization forced the banks to reduce the rate of interest on the fd.

CEO of Outlook Asia Capital, Manoj Nagpal, stated that the fixed deposits offered by bank come with an interest rate of 7%. The after-tax return offered by these fixed deposits is between 5% and 7% depending on an individual’s tax slab. For individuals who are in higher tax slab, this will help for matching the inflation. He added that are some banks do offer higher rates of interest with their FD. He stated that most of the asset classes that can replace gold and real estate are not being able to give proper returns in the short term. Right now, equity seems to emerge as one of the ideal alternatives. In case an individual’s objective is to be safe, then he/she must remember that equities come with substantial volatility.

Nagpal mentioned that small savings scheme like the five year National Savings Certificates provide a better alternative for the investors. However, the lock-in period is a bit longer and that is something that can be taken into consideration.

The senior citizens can go for the Senior Citizen Savings Scheme. LIC is going to launch the Varishtha Pension Bima Yojana which can also prove to be a good option for the senior citizens. The Varishtha Pension Bima Yojana that will be launched by LIC is a pension scheme designed for the senior citizens. This particular scheme will offer assured pension based on guaranteed return rate of 8% for a span of 10 years. Among the debt mutual funds, the accrual funds can definitely prove to be good for the conservative investors. Reserve bank of India has already cautioned people about the high risks related to inflation. All the conservative investors must reduce the allocation to the debt funds of long duration. The accrual funds primarily focus on yielding interest income from underlying bond coupons. Debt funds, on the other hand, try gaining from the downward or upward movement of the rates of interest in the economy. The mutual fund research head of Fundsindia, Vidya Bala stated that all the conservative investors must consider the accrual funds in the mutual funds.

In case the investors do not have a long time frame, ultra short term and short term funds are highly recommended by Vidya Bala. If individuals require regular income, the systematic withdrawal can be used to withdraw funds from the short term debt funds. According to her, not only the debt funds generate great returns, but also they can prove to be more tax efficient than the bank fixed deposits.

Comments

Post a Comment